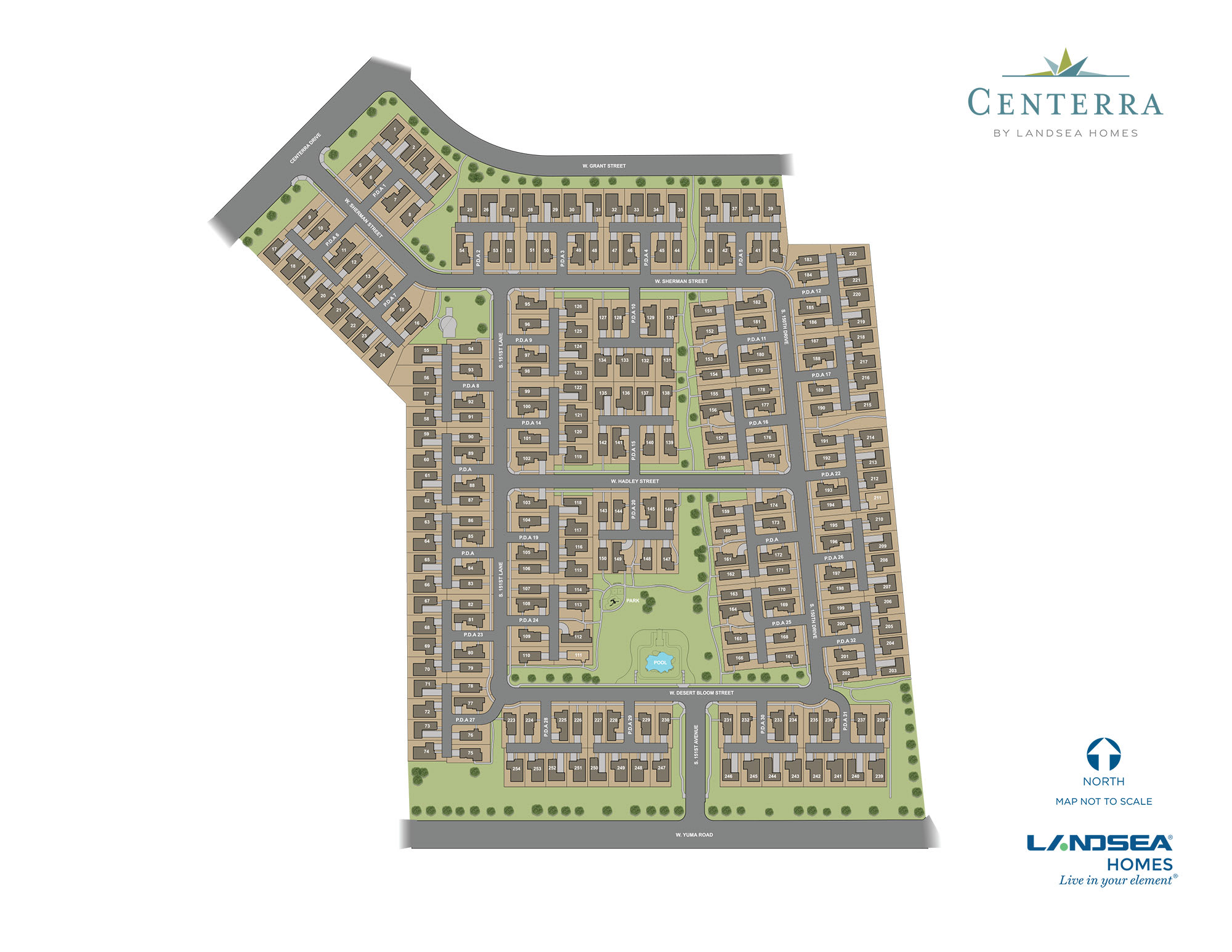

Only 1 home remains in this community! Call us today to speak to a sales counselor & learn more about Lot 109!

Say hello to new, thoughtfully designed homes at Centerra in Goodyear, Arizona, with LiveFlex® options and open-concept living spaces with endless opportunities for gathering with family, friends and neighbors. With a central location for on-the-go lifestyles, residents can enjoy local shops and services at nearby Estrella Crossroads, catch a NASCAR race at Phoenix Raceway or spend the day at Goodyear Ballpark for an MLB Spring Training Cactus League game. Come home to a unique expression of modern living at Centerra.

View Gallery

View Gallery

Centerra

Final Home for Sale in Goodyear, AZ

Live the High Performance Life

Our High Performance Homes are responsibly designed to respect the planet—with money-saving innovation to stay healthier and more comfortable, and home automation technology supported by our partnership with Apple® so it's easier to take on every day. And easier to just be you.

Experience HPHExplore the Area

Communities near Centerra

By Appointment Only

Request Info

If you have questions, would like a brochure, or to schedule a visit, please complete the form and our sales team will contact your shortly.

*FHA – 3.99% (4.714% APR) based on 3.5% down payment

VA – 3.99% (4.186% APR) based on 0% down payment

Conventional – 4.99% (5.052% APR) based on 20% down payment

**For a limited time, Landsea Homes is offering below-market interest rates valid on new home contracts for eligible properties closing by 4/30/2025 (the “Promotion”). Landsea Homes has locked in, through Landsea Mortgage, fixed interest rates using a pool of funds. Interest rates are only available through Landsea Mortgage until funds are either depleted or rates expire. Interest rates are subject to change daily and without notice.

Applicants are subject to qualifications for specific loan terms, occupancy, down payment, credit and underwriting requirements and/or investor program guidelines – not all applicants will be eligible for the Promotion. For eligibility, an applicant must (1) pre-apply with Landsea Mortgage by visiting www.landseamortgage.com prior to submitting an offer to qualify for the Promotion; (2) utilize the services of Landsea Homes’ closing agent and finance with Landsea Mortgage; and (3) satisfy all other eligibility criteria of Landsea Homes and/or Landsea Mortgage. Applicants are not required to finance through Landsea Mortgage; however, the Promotion is only available through Landsea Mortgage.

This is a co-marketing piece with Landsea Homes. Landsea Mortgage is a Division of NFM, Inc. NFM, Inc. -NMLS #2893. NFM, Inc. is an Equal Housing Lender. NFM, Inc. dba Landsea Mortgage, has a financial relationship with the home builder Landsea Homes and you may choose not to use NFM Inc, dba Landsea Mortgage as your lender in connection with the purchase of a Landsea Home. You are entitled to shop around for the best lender/real estate company for you. This is not a credit decision or a commitment to lend. Landsea Mortgage cannot predict where rates will be in the future. Make sure you understand the features associated with the loan program you choose and that it meets your unique financial needs. For full agency and state licensing information, please visit www.nfmlending.com/licensing. NFM, Inc.’s NMLS #2893 (www.nmlsconsumeraccess.org). NFM, Inc. is not affiliated with, or an agent or division of, a governmental agency or depository institution. Landsea Mortgage powered by NFM Tempe branch is located at 58 S River Dr, Suite 330, Tempe, AZ 85281. Branch NMLS #1490627. Branch licensing information: AZ 0121417. NFM, Inc. d/b/a NFM Lending. NFM, Inc. is licensed by AZ #0934973; MLOs and company are CA licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act. CA #6039416 and 4131349; CO #2893; FL # MLD174 and MLD795; TX # 2893 (dba NFM Consultants, Inc.). Copyright © 2025 NFM, Inc. dba NFM Lending. America’s Common Sense Lender® Trade/service marks are the property of NFM, Inc. and/or its subsidiaries. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act.